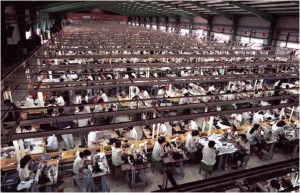

Manufacturing activity in China increased during May as a number of government stimulus incentives started to take hold.

Manufacturing activity in China increased during May as a number of government stimulus incentives started to take hold.

Beijing rolled out a series of policies of pro-growth over the past few months as the second largest world economy has been showing signs of slowing down after rapid expansion for years.

The purchasing managers index in China, which is an indicator of how well the large industrial manufacturers are, ended May at 50.8, the highest it has been in 2014 and up from April’s 50.4.

Another index that HSBC publishes and focusing on smaller and private companies indicated there was improvement in manufacturing in May, with a reading for May of 49.7 compared to April’s 48.1.

Although it still was below the 50 reading, which indicates the difference between an expansion and contraction, it was the highest reading for 2014.

The economy in China is weaker than during any time since the financial crisis, as large debt load, weak demand globally, over capacity and real estate bubbles bursting is all weighing on the economy’s growth.

South Korea said its exports to China were down 9.4% during May compared to the previous year highlighting the continued slow demand in China. The drop was the sharpest since August of 2009.

Korean exports in contrast to Europe were up by 32% in May compared to the same month last year, while exports destined for the United States were up by 4.5%.

One particular concern in China is the slowdown in its real estate market. That market has been one of the key drivers of the country’s economy over the past decade, but also has created a bubble in certain section of China.

Average new home prices dropped during May from April, the first contraction in close to two years.

GDP was up by 7.4% from the same time last year, the slowest pace for the past year and down from an expansion of 7.7% during the fourth quarter in 2013.